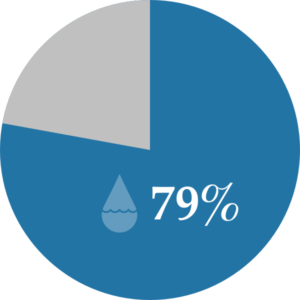

According to the Sun Sentinel, seventy-nine percent of claims in Florida in 2014 were attributable to some form of water damage.

Common Sources of Water Damage

Repairing a property after suffering water damage can be very expensive. Sometimes it is necessary to extract broken pipes from beneath a concrete slab, requiring replacement of a home’s flooring. Other times, it is necessary to completely replace a damaged roof. In the worst circumstances, a homeowner may be required to find alternative living space while these repairs are made.

There’s a solution.

Fortunately, most homeowners have insurance policies that cover these large expenses. Recently, however, insurers in Florida have been quietly trying to reduce your coverage for covered water damages. Insurance Companies often insert language into their policy that create arbitrary limits or, even worse, complete exclusions for water damage. An insurer will often slip these limitations and exclusions into your policy when they mail you an automatic renewal. You will not even get a phone call.

If you do not read your new policy (again, you are not alone), you will never know that you lost coverage for water damage. As a result, you will still be paying the same insurance premiums and have no coverage for the major cause of loss covered by property insurance policies! Considering that water damage is the cause of approximately seventy nine percent of claims, you may end up facing the prospect of paying for expensive repairs that you thought were covered out of pocket.

Getting the coverage you were promised.

At Vargas Gonzalez Baldwin Delombard, LLP, our team of water damage claims attorneys are dedicated advocates for property owners that have been wronged by the insurance company that promised to protect them. We have seen thousands of insurance policies and have seen insurers wrongfully deny and underpay claims by attempting to apply inapplicable policy exclusions and limitations. In these cases, we work tirelessly to get our clients the coverage that they were promised and overturn these wrongful denials.