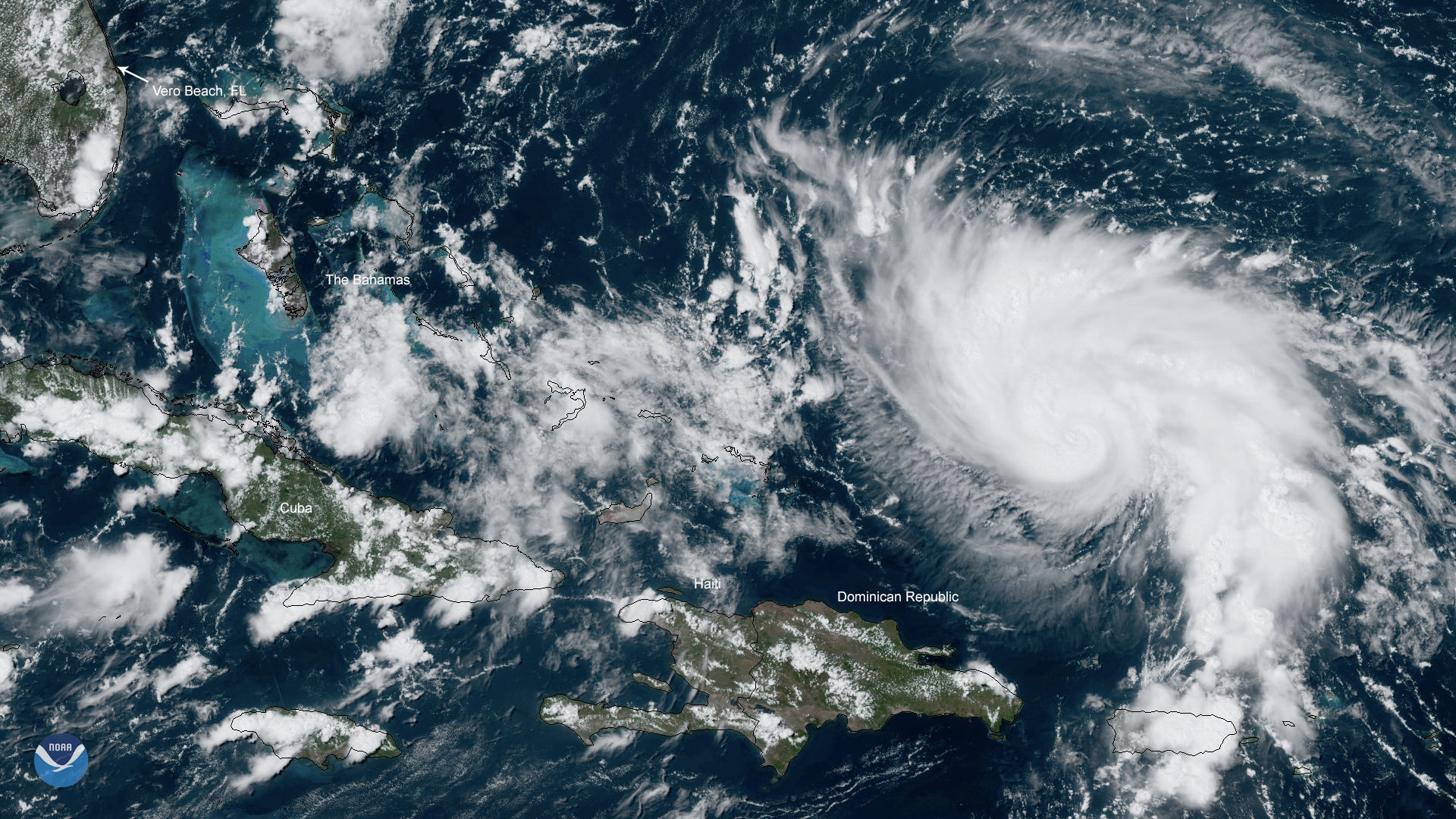

When it comes to the unpredictable, destructive force of a hurricane, such as Hurricane Dorian, even the best efforts to protect your home or business cannot guarantee protection from damage. To make sure your insurance claim is handled after the storm hits, there are three must-do’s:

1. Document Your Loss From the Hurricane

To prove loss to your insurance company, it’s highly recommended to create a photographic record and inventory of your damaged property. This is the best way to strengthen your claim. Start from the outside taking wide shots of all four sides, yard, and as much as the roof as possible. Move closer to get more detailed shots, writing down the damage in list form as you go.

Once satisfied with the outside, move indoors going room by room paying closer attention to walls, corners, windows, and ceiling. Finally take pictures of individual items, noting which room they’re in on your inventory list

If possible, try to include the following when describing the items on your inventory list:

Brand

– Model numbers if any

– Age

– Location of purchase

– Purchase price

Here are some tools and pre-made checklists you can use to help organize your inventory:

1. HomeZada (Free – Basic Version) – The HomeZada tablet and smartphone app (basic version) will give you what you need to quickly and easily do your home inventory.

2. Home Inventory List – Free Microsoft EXCEL template.

3. Home Inventory List – Free Google Docs Template).

2. Cover Your Damage

Use a tarp or something similar to cover up damaged areas to prevent further wind or water damage. You want to be as thorough as possible because insurance companies will scrutinize these areas looking for any reason to claim damage was sustained further after the storm. This is a common tactic to deny your claim.

Below are some common signs of damage to look out for:

Roof

– Shingles missing

– Dented or bruised asphalt shingles

– Broken or cracked tile/ concrete shingles

– Small debris collecting in gutters or downspouts

– Dents on vents, gutters or flashing

– Leaks in roof or ceiling

Exterior

– Splitting or cracks

– Dings or dents

– Discoloration or chipping

– Breaks or holes

Window Damage

– Windows shattered

– Holes

– Cracks

– Broken panes

– Frame damage